Developed from people’s growing appetite for quick, short-form storytelling, micro-drama apps are expected to generate a massive $11 billion economy. And the timing couldn’t fit better, with the holiday season right around the corner, when screen time naturally surges. As they fall more and more in love with short-video, this opens up significant opportunities for microdrama apps to push their presence among a highly engaging audience in their holiday binge mode, turning Q4 into a make-or-break time.

Here, the right ad plan might just unwrap the kind of holiday campaign you wish for, that helps glide past the season’s ad Grinch i.e.,

- Tier-1 CTV Inventory squeeze; CPM inflation and frequency fatigue.

- Fragmented attention shifting to quick, short-form videos especially for last-minute, mobile-first shoppers.

- Attribution gaps on CTV-only plans; limited last-mile performance signals.

- Static creatives burn out quickly, leading to low thumb-stop rate in peak sale clutter.

- Regional nuance: demand spikes in Tier-2/3; language & price-point sensitivity.

And what would possibly work better than impactful mobile performance campaign tailored to meet your ideal audience where they genuinely spend time, when they are ready to install. To work it smoothly however, they need to start early!

Take the Early Arrival Edge

The most successful apps don’t wait until the 24th of December, they start ramping in late November or early December, when audiences are already thinking about year-end downtime, gifting and cosy indoor entertainment. This early start builds signal and user density that pays off during the peak “Christmas to New Year” binge window. Early user aquisition mean stronger data signals and better optimization when competition peaks.

In India and Southeast Asia, festive breaks, family gatherings, and travel time make for high scroll hours, a sweet spot for snackable stories.

Fix In-depth Goals

Instead of just “downloads”, shift to in-depth audience goals that watch through rate and session frequency like “episodes watched per user”, “retention after 7 days”, “in-app episode purchase / upgrade”, and “social share / story-snap after finishing episode”. This helps move beyond vanity insights and offer a broad view for easy differentiation of the right audience who stayed from who only showed up once, allowing you to invest in the right platform where attention is real. And when you optimize ads to relate with your audience, they are more likely to stay fostering long-term retention.

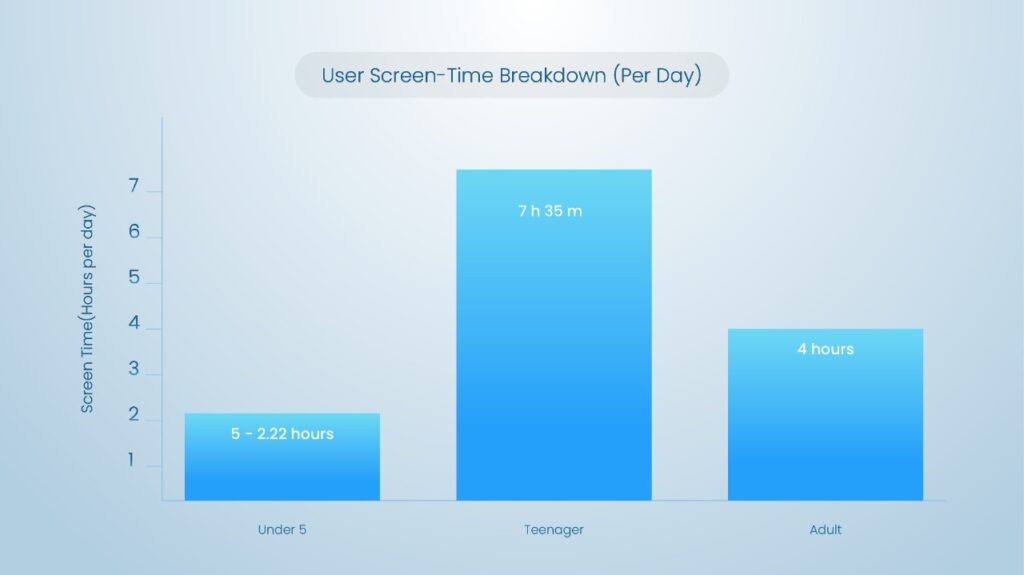

This is a highly fruitful game plan in India, where data shows viewer screen time rises substantially, making it an ideal time for targeting! And you can make the best of it with ai-driven in-depth targeting that precisely segments your most relevant audience to push installs.

Multi-Channel For The Win

Mobile user acquisition remains essential, but top apps this year are breaking the mold with sharper, multi-channel strategies. They’re leaning into second-screen behavior—when families gather around CTV for Christmas specials, a quick 10-second promo on smart-TV ad networks or streaming platforms becomes the perfect nudge to drive viewers back to their phones.

Geo-targeting has also become more intelligent. Advertisers are mapping campaigns to travel and timezone patterns: Tier-2/3 Indian cities where families reunite in December, and Southeast Asian markets where holiday travel spikes mobile screen-time, making viewers far more responsive to snackable entertainment.

What ties these efforts together is the rise of self-serve unified DSPs. Instead of juggling fragmented platforms, advertisers now plan, launch, and optimize CTV, mobile, and rich media campaigns in one workflow.

Budget Smarter Around Key Days

For holiday-season apps, certain days are high-impact: Christmas Eve, Christmas Day, the weekend after, New Year’s Eve, New Year’s Day. These days see surges in downtime, screen activity, and binge-behaviour.

Smart budgets recognise this by:

Allocating higher share of weekly budget to those key days (and days immediately adjacent).

Using fixed daily budget or bid caps to maintain bidding power when competition surges.

Extending the “peak period” beyond just 24-25 December: include 26-31 December and early January — many users continue downtime into New Year holiday.

Optimising for lifetime value (LTV) rather than only first-week installs. For example, target users willing to binge across 3-5 episodes and convert.

Standout Ad Formats

The right ad placement give micro-drama apps a direct way to reach active users in their discovery moments. Formats like icon ads, splash screens, in-app videos, native units, and carousels help surface the app in contexts where users are already in a content-seeking mindset. Because these placements appear within OEM surfaces, app-discovery channels, and relevant entertainment apps, they create a natural flow from curiosity to install.

Here are the top ad formats to leverage for the season!

Placements That Works

As the holidays draw closer, mobile becomes an easy place for audiences to unwind, browse and discover something new. For micro-drama apps, leaning into this natural behaviour with thoughtful performance planning and the right placements can create strong momentum. A steady early start, engagement goals and formats that fit holiday browsing habits can help turn it into a smooth, organic growth phase, without pushing too hard.